Investment plays a crucial role in the economy by driving capital accumulation, innovation, and long-term growth. The investment demand curve, a fundamental concept in economics, illustrates the relationship between the interest rate and the quantity of investment demanded by firms. This article explores the nature of the investment demand curve, its key determinants, and its broader economic implications.

Understanding the Investment Demand Curve

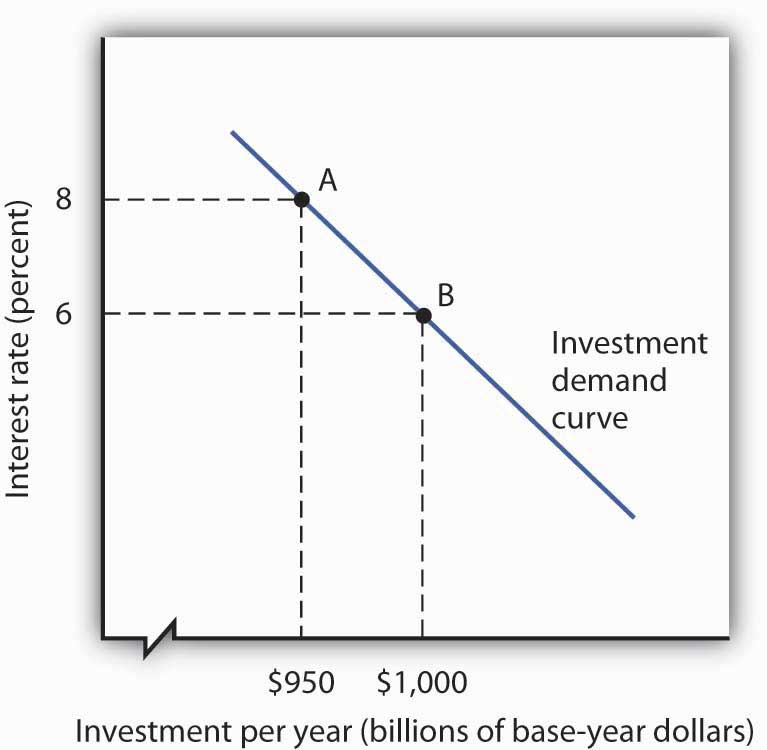

The investment demand curve graphically represents how changes in interest rates influence the level of investment expenditures. The curve is typically downward-sloping, indicating an inverse relationship between the interest rate and investment demand. When interest rates are high, borrowing costs increase, leading firms to reduce their investment spending. Conversely, lower interest rates make borrowing cheaper, encouraging firms to invest more in capital projects.

The downward slope of the investment demand curve is rooted in the principle that firms seek to maximize profits. When borrowing costs rise, the expected return on investment must be sufficiently high to justify the expenditure. If the return on a potential investment is lower than the cost of financing it, firms will forego that investment.

Key Factors Affecting the Investment Demand Curve

Several factors influence the position and shape of the investment demand curve:

1. Interest Rates

The most significant determinant of investment demand is the interest rate. As interest rates rise, the cost of financing capital investments increases, discouraging borrowing. Lower interest rates, on the other hand, stimulate investment by making loans more affordable.

2. Expected Returns on Investment

Firms make investment decisions based on the expected profitability of capital projects. If businesses anticipate high returns due to strong consumer demand, technological advancements, or improved productivity, the investment demand curve will shift outward, indicating a higher level of investment at any given interest rate.

3. Business Confidence and Economic Outlook

Investor sentiment and economic forecasts significantly impact investment demand. In times of economic uncertainty or recession, firms may hesitate to commit to large capital expenditures, shifting the investment demand curve inward. Conversely, in a booming economy, firms are more likely to invest in expansion, shifting the curve outward.

4. Technological Innovations

Advances in technology often lead to new investment opportunities. The development of new machinery, automation, or production techniques can enhance productivity and make investments more attractive. As a result, technological progress can shift the investment demand curve to the right.

5. Government Policies and Taxation

Fiscal policies, such as tax incentives for capital investment or subsidies for research and development, can encourage firms to invest more. Conversely, higher corporate taxes or restrictive regulations can deter investment, shifting the demand curve to the left.

6. Cost and Availability of Capital Goods

The price and accessibility of machinery, equipment, and raw materials influence investment decisions. If capital goods become more expensive, firms may reduce their investment spending. Conversely, lower costs or improved supply chain efficiency can enhance investment demand.

7. Global Economic Conditions

Since businesses operate in an interconnected world, global economic trends can affect domestic investment demand. For example, increased foreign demand for goods can encourage firms to expand production capacity, increasing investment. Conversely, global financial instability may reduce firms’ willingness to invest.

Implications of the Investment Demand Curve

Understanding the investment demand curve has several important implications for policymakers, businesses, and investors.

1. Monetary Policy and Interest Rate Decisions

Central banks, such as the Federal Reserve, use interest rates as a tool to influence investment demand. Lowering interest rates can stimulate economic activity by encouraging investment, while raising rates can help control inflation but may reduce investment spending.

2. Business Strategy and Capital Budgeting

Firms must consider the prevailing interest rates and economic conditions when making investment decisions. By analyzing the investment demand curve, businesses can determine the optimal timing and scale of capital expenditures.

3. Economic Growth and Employment

Investment is a key driver of economic growth. Higher investment levels lead to increased production capacity, job creation, and technological advancements. Policymakers often focus on stimulating investment to promote long-term economic development.

4. Risk Management for Investors

Investors in financial markets should consider how interest rate changes impact corporate investment behavior. Lower investment demand due to high interest rates may lead to lower corporate profits, affecting stock prices and dividend yields.

5. Fiscal Policy Formulation

Governments can use tax incentives and public investment initiatives to shift the investment demand curve, fostering economic growth. Policies aimed at reducing uncertainty and encouraging innovation can also stimulate investment.

Conclusion

The investment demand curve is a vital concept in economics, illustrating the relationship between interest rates and investment expenditures. Various factors, including interest rates, business confidence, technological innovation, and government policies, influence the position of the curve. Understanding these dynamics helps policymakers design effective monetary and fiscal policies, assists businesses in strategic planning, and informs investors about potential market trends. By fostering an environment conducive to investment, economies can achieve sustainable growth and prosperity.

Leave a Reply